td ameritrade taxes on gains

Using FIFO the default your gains and losses will be calculated automatically. Your choice of tax lot ID method can have a significant impact on the amount of taxes you may pay when you sell an asset.

The firm was rated 1 in the categories Platforms Tools 11 years in a row Desktop Trading Platform.

. Margin interest rates vary among brokerages. TD Ameritrade review. Select the TD Ameritrade account thats right for you.

In many cases securities in your account can act as collateral for the margin loan. A 065 per contract fee applies for options trades with no minimum balances on most account types. In 2018 TD Ameritrade conducted a survey of 1503 US.

TD Ameritrade review. Exchangelisted stocks ETFs and options. A TD Ameritrade account thats approved for margin trading must have at least 2000 in cash equity or eligible securities and a minimum of 30 of its total value as equity at all times.

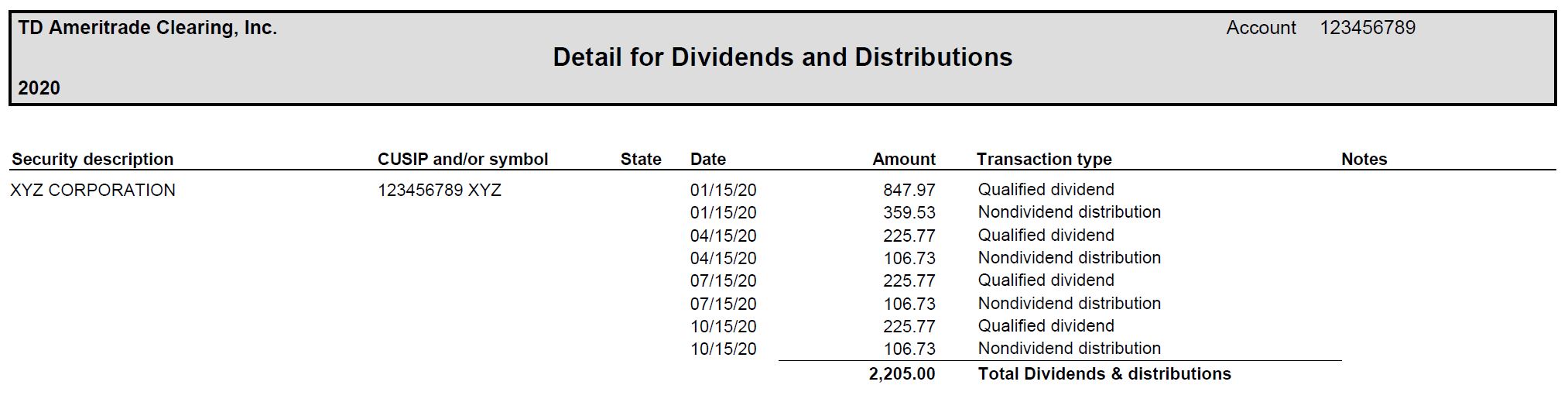

Online trade commissions are 000 for US. And real-time reporting of realized and unrealized capital gains margin. Long-term capital gains refer to investments held more than a year and tax rates are 0 15 or 20 depending on income amount and filing status.

Qualified dividends are taxed at. The rules are a little different if you lost more than you made. Active Trading 2 years in a row Options Trading Customer Service and Phone Support TD Ameritrade was also rated Best in.

Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts. Youd report both on your taxes and youd owe 2000 in capital gains 15000 in gains minus 13000 in losses. Taxes Insurance Reviews Ratings.

Thinkorswim 10 years in a row Active Trading 2 years in a row Options Trading Customer Service and Phone Support. Adults aged 45 and older with more than 250000 in investable assets including 753 individuals who said they are financially independent. You wont incur capital gains taxes for buying or selling assets as long as you dont withdraw funds before retirement age.

You can deduct up to 10000 5000 if married filing separately of combined property taxes and either state and local income taxes or. You can sell your primary residence and avoid paying capital gains taxes on the first 250000 if.

Options Open Interest Analysis Option Strategies Option Trading Options Market

Here S How To Minimize Taxes When Investing Youtube

Day Trading Don T Forget About Taxes Wealthfront

Economies The World Over Are Stagnating This Is Why Https Www Webzoly Com News Economies The World Over Are S Retirement Planner Economy Investment Analysis

What Is Tax Loss Harvesting Ticker Tape

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What Is Tax Loss Harvesting Ticker Tape

How To Pay 0 Capital Gains Taxes With A Six Figure Income

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Merrill Edge Review 2022 Pros Cons And How It Compares Nerdwallet Health Insurance Companies Interactive Brokers Online Broker

Taxes On Stocks What Will You Have To Pay

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape